Weekend Market Report

Welcome to another edition of the Weekend Market Report! In this weekend's report we cover the new Silver and Gold price direction forecasts, the S&P500 historical volatility direction forecast, NASCAR's first electric race car, Dior ripping people off, and AMD getting into the AI race. We close the report with some observations on Costco (COST).

General market commentary

The markets came roaring back this week, after a shortened trading session the week before. Almost all the the indices I track: Dow Jones, S&P500, and Russell 2000 closed higher this week. The tech laden Nasdaq closed a tad lower, which is interesting.

In fact, there was a lot of interesting volatility across the markets that caught my eye. Many tech stocks had an amazing rally by Wednesday's market close only to be slammed hard the next day.

NVDA got slammed hard on Thursday and couldn't recover enough to close over $130 - a key price level IMHO.

Yet, IWM the Russell 2000 proxy ETF showed some price gap ups on heavy volume. Readers of this site will know that I profiled IWM on this previous Weekend Market Report.

For all the coin collectors and bullion traders, this week's gold and silver price directional forecasts for next week are out!

Right now the gold price forecast model is currently 67% correct as last week's price forecast was for gold to close higher and it did. The silver price forecast model is currently 67% correct as last week's price forecast was for a lower close this past Friday but it turned higher.

The S&P500 historical volatility forecast was for lower volatility last week and initial data shows the forecast to be wrong, so the model is currently 50% correct.

NASCAR unveils its first electric racecar

Wow, this is pretty darn cool! The first electric race car!

The top motorsports series in North America partnered with Chevrolet, Ford, Toyota and electrification company ABB to demonstrate a high-performance electric vehicle and gauge fan interest in electric racing.

I really like this idea and I hazard to guess that it will also make things safer, no longer cars exploding after an accident into fire. Of course they'll be using lithium batteries - which can explode - but the risk would be lower than combustion based engines.

The Associated Press got a first look at the $1.5 million prototype. The only person who has driven it so far is semi-retired NASCAR driver David Ragan. The plan is to put the car on the Chicago street course for some fast laps on Sunday morning.

Ragan said the sound and smell were unlike anything he has experienced since first hitting the racetrack at age 11. He could hear squealing tires. He could smell the brakes. In gasoline-powered cars, the engine’s sound and smell and heat from the exhaust overpower everything else. But after hundreds of laps, this time Ragan’s ears weren’t ringing. It was really wild, he said. - via AP News

I can't wait to see how the electric vehicle industry will change racing in the future!

Dior handbags are a rip off

Ok, I don't own any Dior handbags, nor does the wife, but the company is definitely ripping off it's consumers. Italian prosecutors found that it only costs $57 to produce these designer handbags (not including leather costs) but Dior ends up selling them for $2,800. That's not only a big rip off but a major exploitation of consumers!

Citing documents examined by authorities, Reuters reported last month that Dior paid a supplier $57 to produce bags that retailed for about $2,780. The costs do not include raw materials such as leather.

How did they make the bags so cheaply? They outsourced them to a Chinese subcontractor that employed Chinese labor that were living in Italy illegally.

The subcontractors were Chinese-owned firms, prosecutors said. They said most of the workers were from China, with two living in the country illegally and another seven working without required documentation. - via Business Insider

Shame on you Dior!

AMD getting into the AI race

Just when you couldn't get enough AI in your daily AI, another company goes all in AI. AMD bought a Finnish AI startup for $665 million dollars to help it add more AI capabilities to it's chips.

Helsinki, Finland-based Silo AI specializes in end-to-end AI-driven solutions that help customers integrate the tech into their products and services. With operations in Europe and North America, the startup counts companies, including Philips (PHG.AS), opens new tab, Rolls-Royce (RR.L), opens new tab and Unilever (ULVR.L), opens new tab among its customers.

Nvidia already has RapidsAI to run on it's chips, so this makes sense for AMD to do this just stay relevant. Considering the money that the Biden Administration pumped into semiconductors via the CHIPS Act, going long selective chip companies will probably make you rich in the coming years.

The acquisition marks the latest step from AMD in a series of moves aimed at expanding its footprint in the AI landscape. Last year, the company acquired AI software firms Mipsology and Nod.ai and has invested more than $125 million across a dozen AI companies over the last 12 months. via Reuters

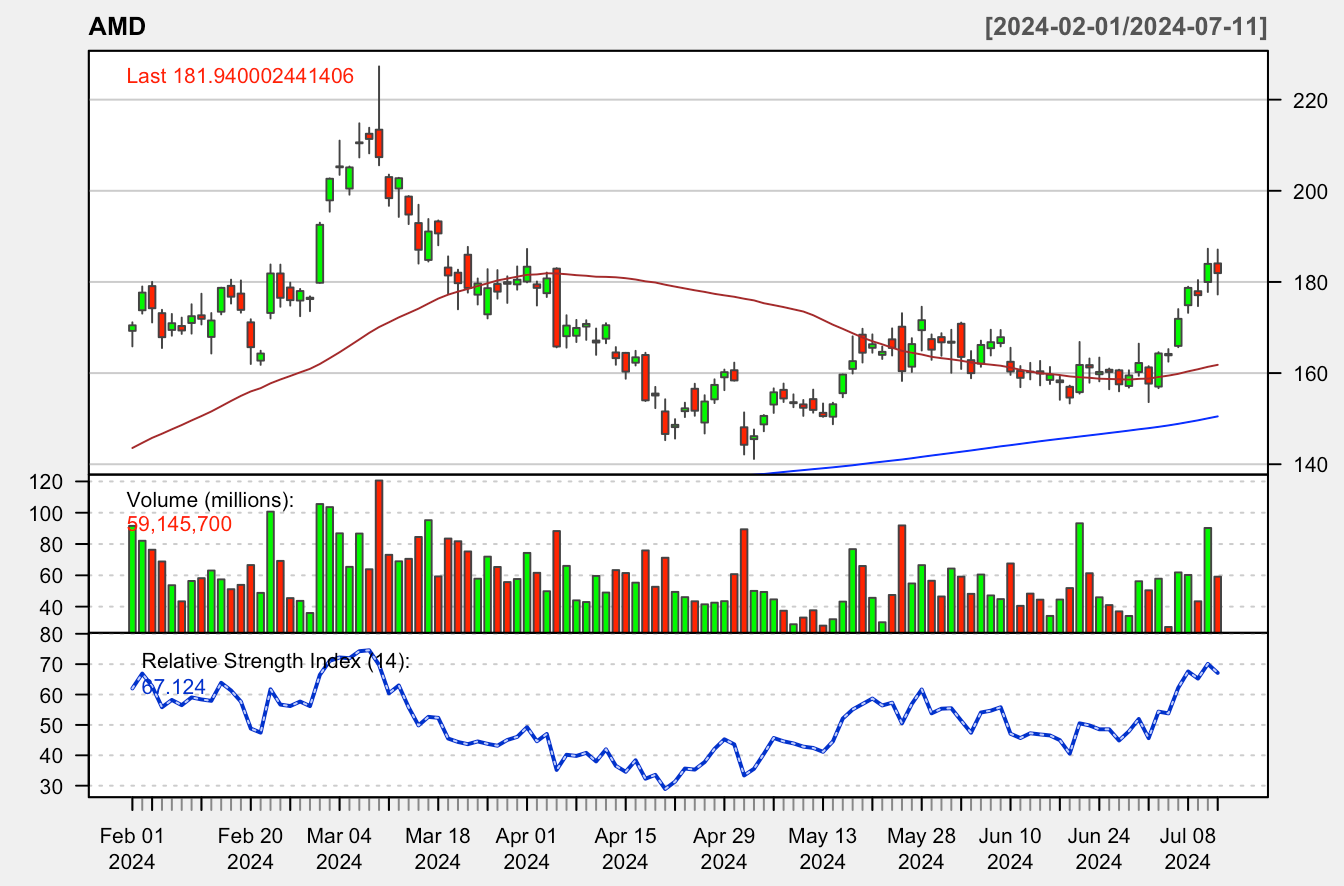

Right now AMD is trading below it's all-time high but above it's 50 DMA. It looks ok but I like to buy all-time highs and will wait this one out.