Weekend Market Report

Welcome to another edition of the Weekend Market Report! In this weekend's report, we dig into the Trump Trade in our spotlight section, we share four great links and graphics, and we present our 1 week ahead forecasts for gold, silver, and the S&P500 historical volatility.

General market commentary

The markets were extremely volatile this week with the Nasdaq, Dow Jones, S&P500, and Russell 2000 closing lower. Some of that volatility was due to comments made at the Republican National Committee (RNC) by former President Trump, now the official nominee.

There is a rumor of a "Trump Trade" being priced in the market which we discuss in the spotlight section of the newsletter below.

Both gold and silver prices fell this week, which was in line with our directional forecasts. Right now both gold and silver price forecast models are 71% correct as last week's price directional forecasts were to close lower and they did.

The S&P500 historical volatility forecast was for higher volatility last week and initial data shows the forecast to be correct, so the model is currently 67% correct.

Taiwan Should Pay For Defense

The one thing that set off an already fragile tech market was former President Trump's comments on Taiwan. In typical Trump form, he suggested that Taiwan pay the United States for defense.

“I know the people very well, respect them greatly. They did take about 100 per cent of our chip business. I think, Taiwan should pay us for defence,” Trump said in interview with Bloomberg Businessweek on June 25 but published on Tuesday.

This sent shares of Taiwan Semiconductor (TSM) and many semiconductors stocks (NVDA, SMH, etc) lower in a very volatile session.

Impact Of 0 DTE Options

As I continued my study of options, I stumbled across this informative post and video about zero-day-to-expiration (0DTE) options and how they affect the market.

As volumes have increased, so have concerns around the market impact of these products. Specifically, the fear is that market makers hedging these options could become outsized relative to the underlying S&P market, and therefore option “gamma hedging” (explained below) may be exerting undue influence on the market. Over the past year, commentators have blamed 0DTEs for everything from exacerbating intraday volatility to suppressing it, with estimates for market maker positioning ranging from “record short” to long $50bn gamma in SPX alone. What’s behind these often contradictory headlines, and crucially, who is right?

The moral of the story is that while 0DTE option trading for the S&P500 is huge, it doesn't affect the market that much.

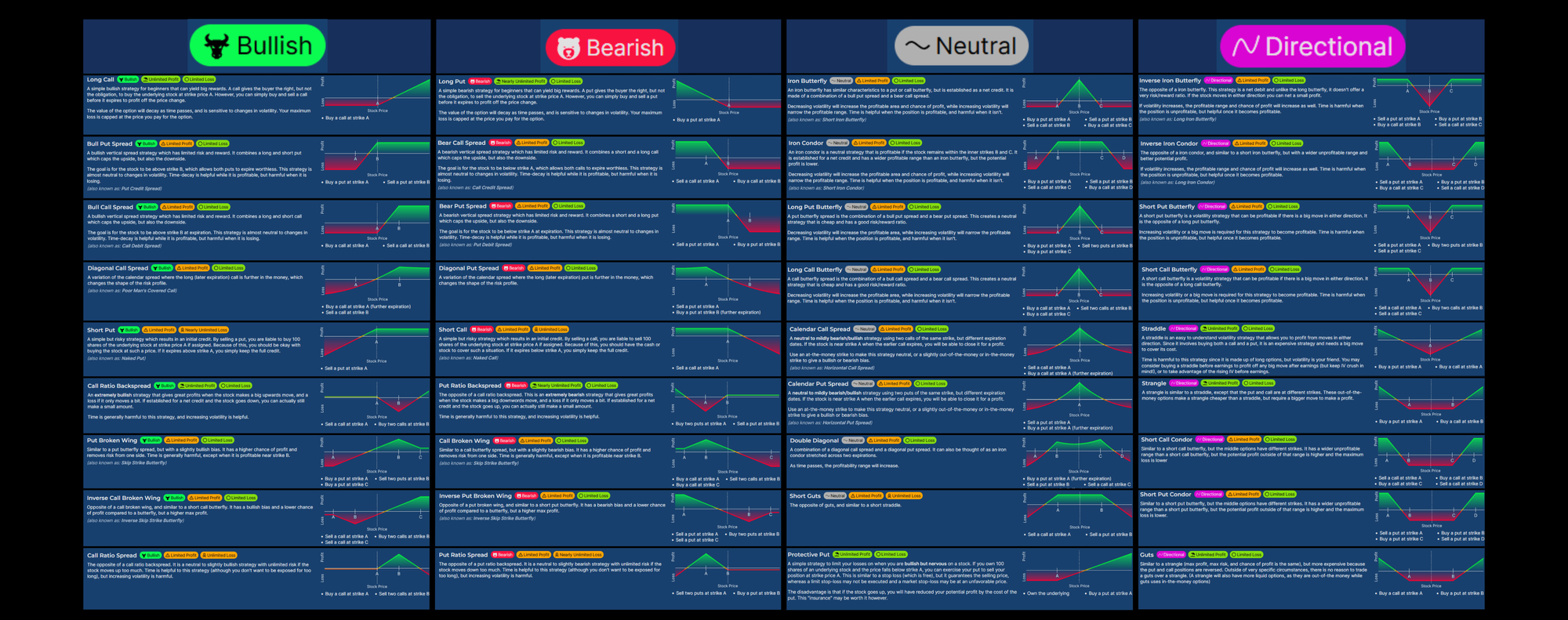

Option Strategy Chart

I found this handy option strategy chart, with profit and loss potential on Reddit, I just don't remember which group.

This is a handy chart with simple and very complex strategies. I used to think that the warnings about options being a sophisticated instrument that should only used by sophisticated traders was a myth to scare away people. I was wrong. Options are tricky trading instruments that can make you a lot of money due to their leverage.

Someone Bought $141 Million 1DTE CRWD Options

Crowdstrike (CRWD) had a terrible day yesterday. The cybersecurity company had a massive outage yesterday that affected millions of people. This outage halted nearly all air traffic yesterday and is a massive black eye for the company.

Yet, someone made a small fortune buying 141 million dollars worth of Crowdstrike (CRWD) put options.

Is this a case of insider knowledge or pure luck? I'm sure the SEC will want to find out.