Terra Tech - TRTC

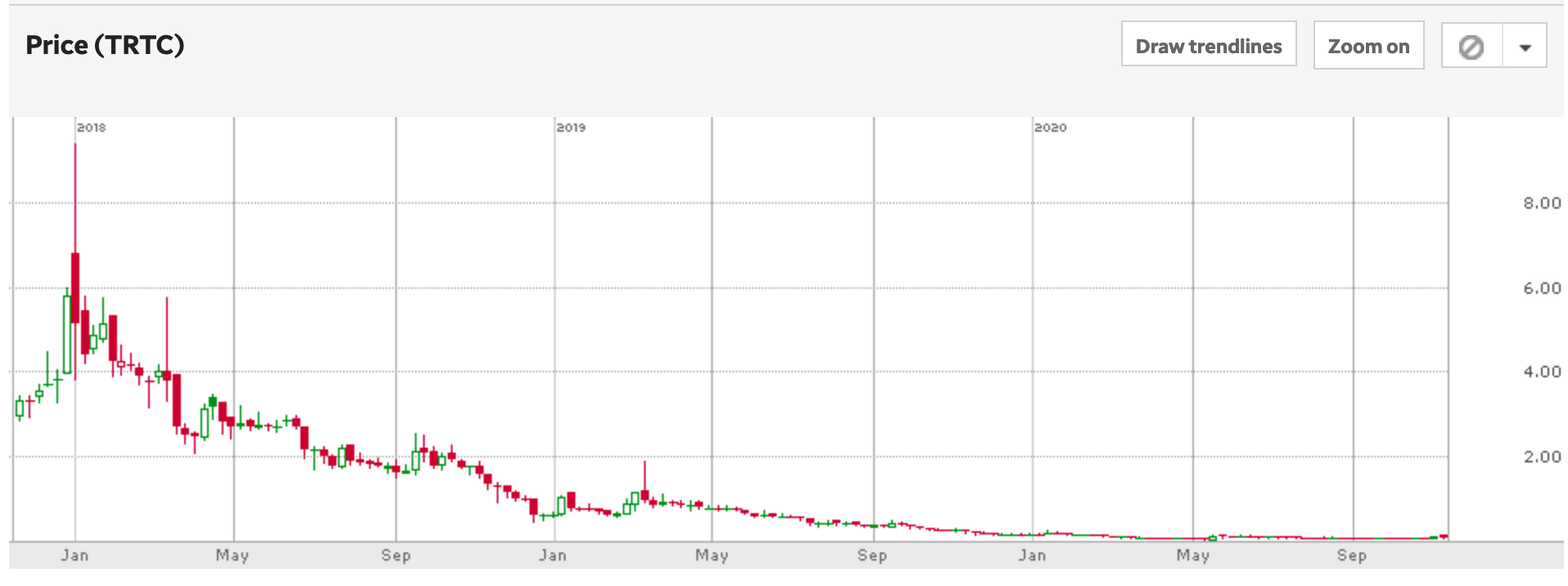

I invested in Terra Tech Corp (TRTC) back in January 2018. Marijuana / Cannabis type stocks were making big moves back then and this company looked like it would capitalize on it. At the time it was trading around the $4 to $5 range and I picked up 200+ shares of it for about $4.82.

Since then I watched it do a reverse stock split and get put on the Pink Sheets. I should've sold but I felt that pot stocks are a long term play as America finally get's their shit together and legalizes it. Still, it hurts a little watching this stock slip into oblivion. This is a classic case of letting my feelings for a better future interfere with what the market tells me.

So I ignored it since mid-2018 and watched my position erode further. This is what TRTC looks like today:

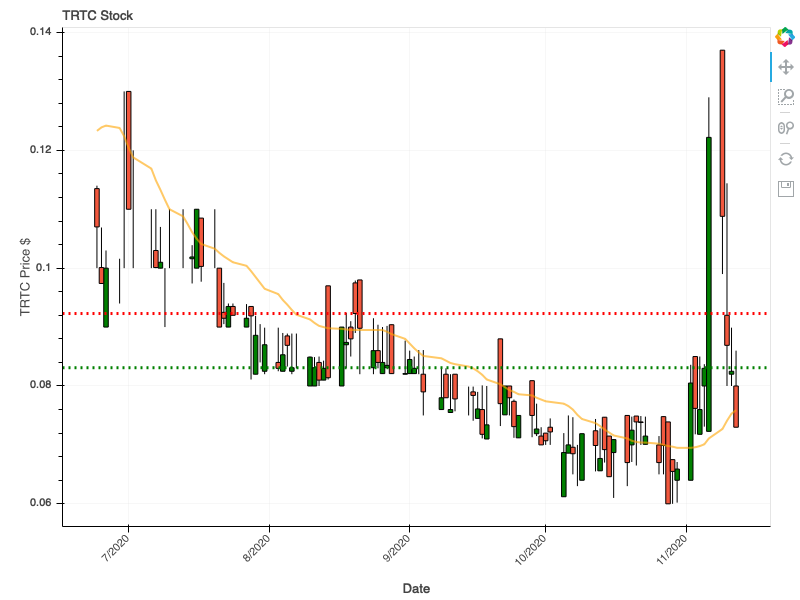

There's been some activity lately, the price broke above its resistance line at $0.09 but promptly closed below its support at $0.08. The reason for the sudden jump in price activity? The latest earnings call and press release. Bag holders (like me), heard some positive news which was summarized in a recent 8-K filing.

For the quarter ended September 30, 2020, the Company generated revenues from continuing operations of approximately $3.05 million, compared to approximately $5.48 million for the quarter ended September 30, 2019, a decrease of approximately $2.42 million. The decrease was due to the combined impact of COVID-19 and civil unrest. COVID-19 has reduced customer traffic and sales volume, while the civil unrest has resulted in damage and closure of one of our dispensaries for half of the month of July and the other for the entire quarter.

In other words, the Black Lives Matter protests disrupted revenue from two dispensaries that they distribute their Marijuana at.

Terra Tech’s gross profit from continuing operations for the quarter ended September 30, 2020 was approximately $1.44 million, compared to a gross profit of approximately $3.18 million for the quarter ended September 30, 2019, a decrease of approximately $1.74 million. Gross margin for the quarter ended September 30, 2020 was approximately 47.1%, compared to approximately 58.1% for the quarter ended September 30, 2019. The decrease in gross margin was mainly due to our revenue decrease, but was also impacted by higher cost of sales. The cost of sales were negatively impacted by lower customer traffic which led to suboptimal purchasing volume which in turn pushed up unit cost.

I always take these 8-K filings with a grain of salt because every press release is ALWAYS framed as GOOD NEWS! The devil is in the details. It looks like costs are creeping into the pot growing and selling business and I suspect that prices will continue to fall as more US states legalize pot. Lower prices = a win for pot smokers but it will kill or force small companies like TerraTech out of business or to merge.

The Cannabis market is going to be one interesting thing to watch in 2021 and beyond.

Update 7/12/23

This cannabis stock has undergone A LOT of changes. Terra Tech is no longer around and probably got bought out by Unrivaled Brands Inc (UNRV). So far, it looks pretty weak and its the only penny stock company I own. Why? I have no idea, I'm a dummy.

Disclosure: Still Long TRTC, UNRV

Member discussion