How to Safeguard Your Investments: Using Trailing Stops in Momentum Trading – A Case Study on USEC

In May 2007, just a month after this blog was created, I wrote about U.S. Enrichment Corp (USEC), a U.S.-based company supplying nuclear fuel for power plants. Back then, USEC seemed like a promising investment, showing up on WallStrip and Google Finance's top gainers list.

I wrote:

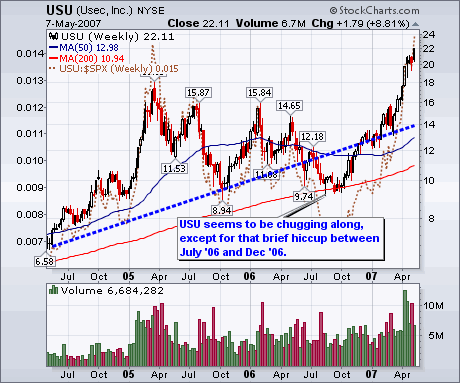

Today was a USEC day for me. First I saw it profiled on WallStrip and then it showed up on Google Finance's top % gainers list. It sure looks like a healthy trending stock as it rises from the lower left corner of the chart to that magical upper right hand corner.

It doesn't take a rocket scientist to figure out that the world needs more energy everyday and with all the fervor about fossil fuels and greenhouse gases, nuclear could be a viable option. The only drawback to nuclear energy is that pesky radioactive waste. So the question you have to ask yourself, do you want to glow or sizzle?

Now, I'm revisiting this post because I was curious about what happened to USEC.

Well, it went bankrupt in 2014 and re-emerged as Centrus Energy (LEU).

How’s Centrus Energy trading these days? As of this article, it’s around the $44 price level, with the 50-day moving average below the 200-day moving average—definitely not a positive sign.

If we look at LEU’s long-term chart, it made an all-time high around $7,000 (see note below) back when WallStrip and I were discussing it. I don’t remember the exact reasons for all the momentum back then, but that chart serves as a cautionary tale for why using stops when trading trends is crucial.

How to Use a Trailing Stop for Momentum Trading

A trailing stop is a dynamic risk management tool that adjusts as the price of an asset moves in your favor. Here's how you can use it effectively in momentum trading:

Setting the Trailing Stop: Start by setting a percentage or dollar amount away from your entry price. For example, if you set a 10% trailing stop on a stock bought at $50, the stop would initially be set at $45.

Adjusting with Price Movements: As the stock price increases, the trailing stop moves up with it. If the stock rises to $55, the trailing stop would adjust to $49.50 (10% below $55). This allows you to lock in gains while giving the stock room to continue its upward momentum.

Protection Against Reversals: If the stock price reverses and hits the trailing stop, the position is sold at the stop price. This mechanism protects your profits and limits losses without requiring you to constantly monitor the stock.

In the case of USEC, a trailing stop could have helped investors avoid significant losses. As the stock climbed, the trailing stop would have moved up, eventually selling the position when the price began to drop, thus preserving gains and mitigating the impact of the subsequent collapse.

By implementing trailing stops, traders can ride the upward momentum while having a safety net in place when the trend reverses. This strategy is particularly effective in volatile markets where price movements can be swift and unpredictable.

Update

Someone on StockTwits mentioned USEC didn't trade at $7000 and he's probably right considering the very first chart has USEC (USU) trading around $22. It probably peaked around $70 and then went into some reverse stock split. I tried hard to find historical data but to no avail. Even though the price action/data is gone, the important lesson of the case study remains: use your stops in momentum trading. It's the only to protect yourself when the trend ends.

Get more with Premium

Member discussion