A Review of my AMD Call Option Trade

Stop trading like a Boomer

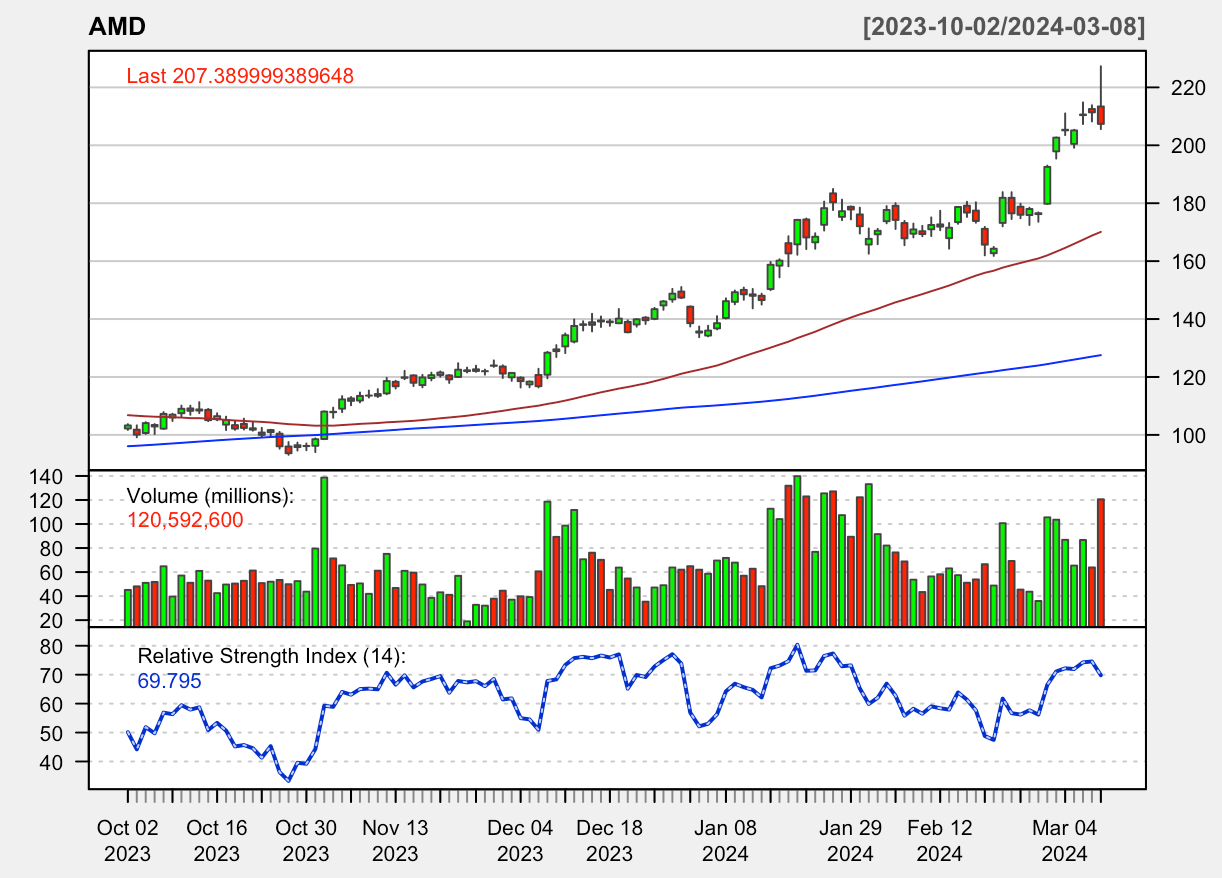

- Why was I interested in AMD? Because it’s getting action for momentum traders interested in the AI market.

- Which way was AMD trading? It was in a long upward trend.

- Was AMD making an all-time high? Yes.

- When did you enter the trade and at what cost? I entered the trade on 3/1/2024. I bought 5 May 17, 2024 AMD Calls for $8.95. Total cost was $4,478.

- What was AMD trading at the time of entry? It was trading around $200.

That was my entry. Now what about the exit? Why did I exit?

- I exited this position by studying the price chart. I didn’t like the long legged dojis that were being formed.

- I liked the first strong candle from $180, it was a small gap and it signaled institutional buying. That helped me make my buying decision but the second gap up and dojis after that made me think it’s wise to take profit, considering how quickly my call options increased in value.

- I sold 5 contracts at market open for $15.06, which banked me $7,526.

Total profit = $7,526 on a $4,478 risk, roughly 0.60:1 reward to risk ratio. This is not the ideal reward-to-risk ratio when trading stocks, but options are a different animal and I need to understand if this was a flawless trade or not.

What could I do better here? I’m not sure but I think time will tell how I do as I learn more about options trading.

Disclosure: No positions now

Member discussion