EWM ETF Past & Present

EWM was good to me in the past, too bad I sold it!

Update

EWM. What a great ETF for investing into the Asia area. This is one of those emerging market ETF's that I should've held onto for the past 13 years. Once again I'm going to repeat what I wrote about passive investing: diversify, buy low cost mutual funds/ETFs, and dollar cost average.

Look at EWM now, trading around $27. It's not that high as I would've liked it to be, especially after 13 years but that's the risk you take investing. However, price appreciation is just one part of the equation when it comes to making money in the markets long term, the other is yield.

EWM's current yield is 3.37%, which is pretty damn great considering all the ups and downs it's had over the 13 years. It survived through the 2008 crash and now the Trump crash.

What I should've done if I was really smart back in 2007 was buy 100 shares and let it sit BUT that's the scary problem. I'd be watching this thing and sell at the latest market sell off. I should've held and dollar cost averaged back at the bottom in 2008. Then maybe a few times more.

What happens if it turns out to be a bad investment if I do all that? Would I be throwing money away? In this particular case, yes.

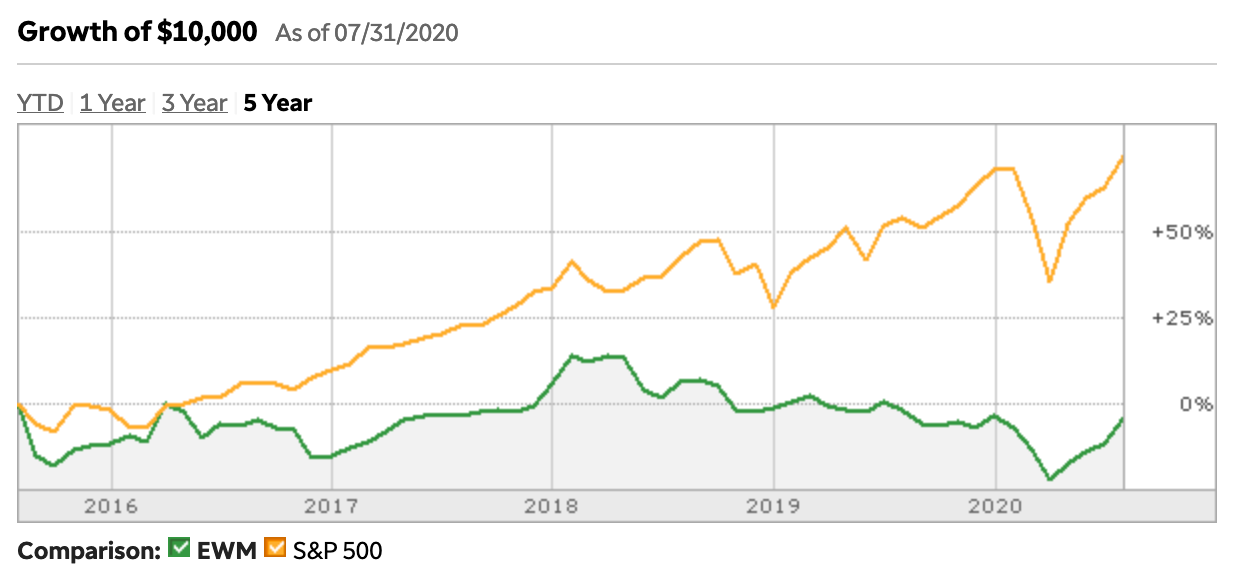

This is what the growth of $10,000 looked like over the last 5 years.

Over the last 5 years, EWM was slightly negative in return. Compared to the S&P500, which was way up. So I'm glad that I sold EWM in hindsight but it still presents the problem you have to face right before you make your first Buy order.

The problem is, will this ETF give me long-term returns for price appreciation and yield? You won't know and it's a risk that you take, hence the whole passive investing philosophy.

IMHO, that's the only true way to make solid wealth.

Woulda, coulda, shoulda.

Buy and Hold + Dollar Cost Averaging!

Essentially I would've more than doubled my investment over 19 years if I just did a 'Buy' and Hold' AND Dollar Cost Averaged! Would it have been risky to buy one ETF or stock over 19 years? Of course. If it had been GE or Ford, well then I'd be kicking myself. If it had been AAPL or AMZN then I would've told everyone what a genius I was.

This is WHY you diversify! Across ALL asset types!

Buying ETFs would be smart here because they're diversified across a specific sector or group. If I had been really keen on Malaysia for the long term, then this would've made sense. Ideally, I should've bought some broad-based International ETF like Vanguards VXUS or the similar.

Woulda, coulda, shoulda.

It's no use crying over this, the right thing to do is get started now. Find some great low-cost ETFs and buy 100 shares in an IRA account. Can't afford 100, then buy 20. The only winning strategy is to do less in the markets and keep your costs low.

EWM 2023 Update

I'm just adding to this old but insightful post. Why is it insightful? Because I was trading EWM back in 2007 and have stepped back and let time pass. Hindsight is always 20/20 but only if you learn from it.

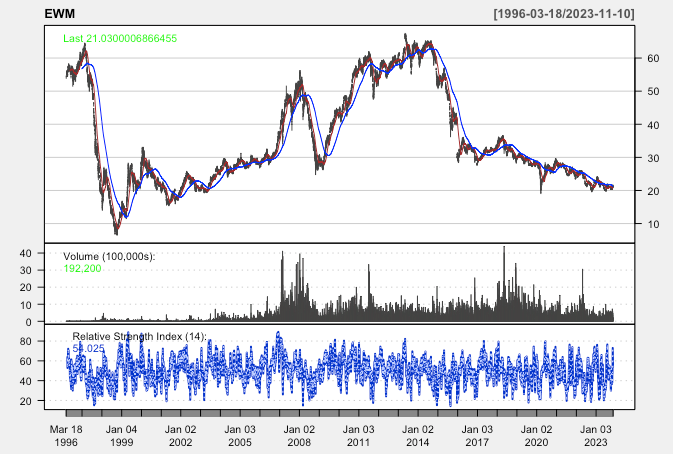

Here's the last 6 months of price action from EWM. It closed around $21 on Friday, after a big rally in the markets. Some say it was a dead cat bounce rally, and I'm tempted to agree. I know not to trust the market when bond yields and stocks move higher.

Zooming out and and looking at EWM for its entire life we see that it hasn't done much either. A similar story is emerging (heh) with FXI.

EWM has been sliding since 2017! Something's afoot in Malaysia and the rest of the emerging markets!

Member discussion