Does Trend Following Work?

Yes, it does, but only if you're smart about risk. What am I talking about? This paper: Does Trend Following Work on Stocks? I came across this paper when it was shared around in my trading and investing circles. I promptly read this paper (see below); its key points have stayed with me ever since.

Why? Because if you're alive, you've seen trends emerge and disappear. You've experienced fashion trends, toy trends, and financial trends. Who remembers the Cabbage Patch doll frenzy or bell-bottom jeans?

The funny thing with trends is that they can appear out of nowhere, hang around longer than you expect them, and then disappear. You can make a lot of money riding trends and the best part? You don't need to be the first one in the trend but you can't be the last one out of them either.

This is why I always loved Howie's original blog tagline, "TRENDS - Find them, ride them and get off!" By the looks of his life, he's been pretty successful in profiting from them.

Has trend following worked for me? Yes, it has, not just in the financial markets but also in my personal life. I made a bit of money trend trading back in the day and I jumped on the AI trend back in 2007 without even knowing it. I was lucky back then and I see no changes to the AI trend. I'm still long!

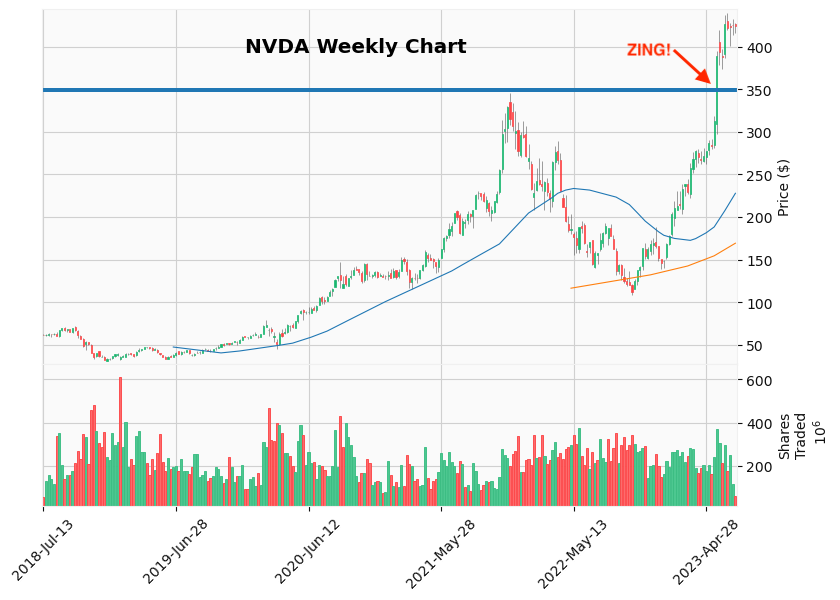

Let's take an example using the paper I linked above. We'll use NVDA, a current holding of mine, as the test case. I bought them because I live and work in the AI startup space and GPUs are used everywhere. Now with Large Language Models (LLMs), faster and more powerful GPUs will be needed. NVDA is the biggest player in town and they're seeing their share price skyrocket through the roof.

It made sense to me so I bought it right as it was breaking to new all-time highs. The all-time high component is the "short-list" you want that separates it from all the rest. You want new all-time high stocks to choose from.

If you follow the methodology that the papers suggest, you would've bought it on a day it was making new highs and then entered a 10 ATR stop. The stop is part of your risk management and you should always use it as protection.

Since that time, NVDA has continued to plow higher and you should adjust the ATR stop higher, never lower. I adjust the stop on Fridays if it goes higher because I have zero time to watch the blinking lights of the markets these days.

NVDA closed at $424.05 yesterday (7/11/2023) so a 10 ATR stop would be placed at $413.11. If the price closes higher today you could adjust it higher or wait like I do.

The best part about this trend-following system is that the market takes you out when it thinks the trend is over. As long as you're disciplined at moving your stops, you can just "set it and forget" until the trend flips and you're taken out.

Usually, these trends take a while to flip because of the nature of momentum and chatter in the news. These trends typically last longer than 12 months, so you get the benefit of lower taxes on your buys and sells (I'm not a tax guy, consult with your tax professional).

You can always reenter a trade if the trend picks back up again if the stock you're looking at makes new all-time highs again. Granted, sometimes the market gets spooked and overreacts, but this simple system's empirical results strongly suggest that trend-following on stocks does offer a positive mathematical expectancy.

And if we remember anything about trading (and life) it's that you need a positive expectancy.

Member discussion