Should you Buy the Market now?

We are living in crazy times. The (Stock) Market is reaching all-time highs when the rest of Main Street is falling apart. Amazon is trading in the $5,000 range and people think the market doesn't represent the majority of us.

I agree. The Market is NOT for Main Street and it will never be. It's for a small group of the population that's seeking to reallocate your funds to their account. The market is rigged and it will forever be that way.

Your first thought is to say "Fuck it, I'm out of here. I won't touch this shit with a 10-foot pole" and that's a valid reaction. But the Market is what makes buying a house possible and will even let you retire one day. You need the Market even if you hate what it does and stands for.

I'm not writing about the evils of the market, I want to explore the question, "Should I Buy into this Market now?" After all, it's making new highs.

The proverbial wisdom is 'Yes' because when the market is reaching new highs it will continue to do so. It will do this as long as it doesn't. Some think that Trump will let the markets 'burn' around Election time.

Others think that a correction is coming during the September/October months. These months are very volatile around that time and others say the market is going to crash because the Fed pumped all this stimulus into it.

What I described above is the Market in a nutshell. All these competing forces drive the market up or down. It all depends on which forces are in control and right now it's the 'keep making new highs' forces.

The way I see it there are two outcomes for an investor like us, the market will go lower or it will go higher from today. How's that for ambivalence?

Should you Sell?

If you want to. The market has had a great run up and it's always a good thing to take profits.

Should you Buy?

If you want to. The markets are on a tear up and even if you catch the tail end, you could make a nice profit.

The Reality

The reality is that you're going to kick yourself if you sell your positions now and the market races up higher. Likewise, you're going to kick yourself if you buy now and the market crashes. So what should you do?

If you wanted to get into the markets now you should do it with a very small buy. If you had 10,000 dollars to invest, take no more than $1,000 of it and buy a diversified ETF or mutual fund. In times of market uncertainty, I find that it's best to be diversified. I also find it smart to manage your risk, putting in no more than 10% of your cash now can make you look smart twice.

If the market crashes and you lose $1,000, then you look smart for not blowing your entire money. If the market charges higher, you look smart for having skin the in game.

Likewise, if you're feeling the market is too top heavy then sell half your positions. This makes you look smart twice. If the market crashes you made your profit. If it goes higher you still look smart for having a position.

When the markets are making all-time highs it's prudent to be cautious and not go 'all in.' The markets will crash again one day because we can't help ourselves, our greed propels us to do so. We do stupid things like buying at the top or selling at the bottom. (If you don't see yourself in this paragraph then be very afraid!)

What we need to do is be data-driven with your investing and manage your risk. So yes, you should buy the market if you want to or sell the market if you want to. Just be smart about it.

October 2020

This is just a short update. It's October 7th and the Markets are in a very volatile place right now. They are trending lower from when they started in September. This is usually an ominous sign, especially for an incumbent President in an election year. We have lightened our load in the markets and remain cautious.

November 2020

What a difference a month makes. We have a new President-Elect and the markets feel better. They'll no longer have to deal with the Trump volatility and can get back to fleecing Main Street. Biden has been Wall Street-friendly and they know they'll have a new sheriff in town to contend with.

November 2023

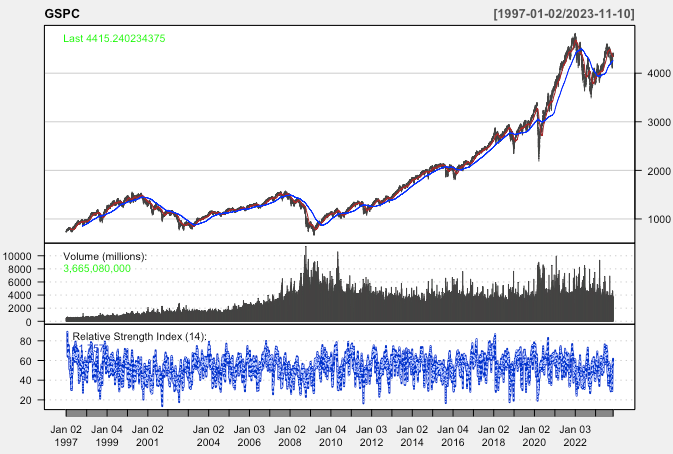

It's been three years since I last updated this article and a lot has happened in the world since Biden's election and COVID. The markets have gone up, pulled back in 2022, and have recovered (not completely though).

If you bought back when I wrote this article you'd been patting yourself on the back and probably smiling. If you bought at the top in Jan 2022, you'd be underwater still. That's the thing with trading, you don't know where the turning points are but you can 'react' and trade with the market direction and momentum. For us long-term investors, you just have to buy and dollar cost average and then let time pass.

For example, I'm sitting on a small fortune in my 401k because I started investing in index mutual funds back in the late 1990's.

The moral of the story? Just get started investing in low-cost index mutual funds, dollar cost average, and don't look often. Make sure to rebalance twice a year for important reasons I write about in another post.

Member discussion