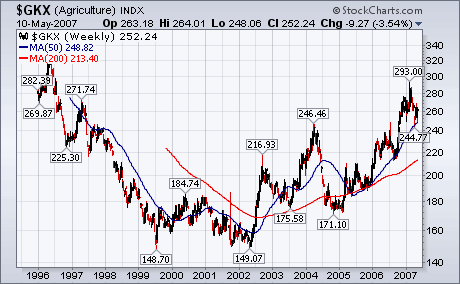

Agriculture Index - ($GKX)

I worked in my vegetable garden for most of the weekend and with every weed I plucked, the words "Ethanol" and "bio-fuel" kept popping in my head. I know that everywhere I turn, I see and hear about how Ethanol is going to save us from oil dependence and global warming.

Despite my skepticism about Ethanol, I am curious to know what set this new trend in the Agriculture index. Exactly what happened at the end of 2001? Was it demand from China? Or a sudden fascination with Cocoa? Inquiring minds want to know!

The Agriculture Index is An index of agricultural commodity contracts, including Wheat, Red Wheat, Corn, Soybeans, Cotton, Sugar, Coffee, Cocoa, and Orange Juice. Compiled by Goldman Sachs, via traderlog.

2019 Update

Back in 2007 I posted about the Agriculture Index (GKX) and wondered why it was so strong. At that time I thought it was related to China or how the demand for ethanol was going to save us from global warming and the effects of man-made climate change. Back in 2007 the index was at $252 and fast forward to today, it's at $285ish.

2020 update

A lot has happened since my last update with GKX. Since 2007 it has appreciated a bit the weekly chart shows that it's been a roller coaster ride. That sounds about right for commodities. I haven't run the analysis but over time they probably revert to the mean price.

In early 2020, Trump started threatening a trade war with China back in 2018 but it didn't hit the farmers until 2019. That's when the volatility started happening. While volatility is great for traders, farmers just want to know what the stable price is so they can adjust their crop sizes.

In typical Trump fashion, there was news of a deal, then no deal, then a deal, etc. The markets reacted up and down but in the end, the weekly chart is flashing a bearish sign right now. The index's 50 WMA is below its 200 WMA, a bearish sign. Still, we should take this with a grain of salt. This bearish flip happened pre-Trump era so US farmers remain on the losing end of things.

Mind you, the GKX index contains more things than just soybeans and grains, it also contains orange juice, livestock, and whatever else is considered agricultural.

So what to do here? I stay away from investing in Futures as a whole but the $GKX is just an index to watch. It's an indication of what's happening to the agricultural products that US farmers produce and right now it looks weak, Trump Trade War or not.

2024 update

Just a short update for 2024 on where the index is trading!

Looks like we missed a run starting right after my last update! Too bad I don't trade Futures.

Member discussion