Agriculture GKX Index Revisited

As a solo finance and trading enthusiast (hack), I've developed a particular stance: I tend to steer clear of Futures. They're a bit too volatile for my taste. However, that doesn't mean I turn a blind eye to the markets. Quite the opposite — I like to keep a "lazy eye" on the pulse of things, especially when it comes to indices that caught my attention in the past.

Take, for example, the Agricultural Index GKX. I first wrote about it back in 2007, a time that now seems like a different world. The price of the index was around $293. Fast forward to 2020, and the landscape has dramatically changed. The then-President Trump's initiation of a trade war with China piqued my curiosity again but the price was lower than in 2007, it was trading at $285. How would such geopolitical tensions impact the GKX? It was a question that lingered in my mind.

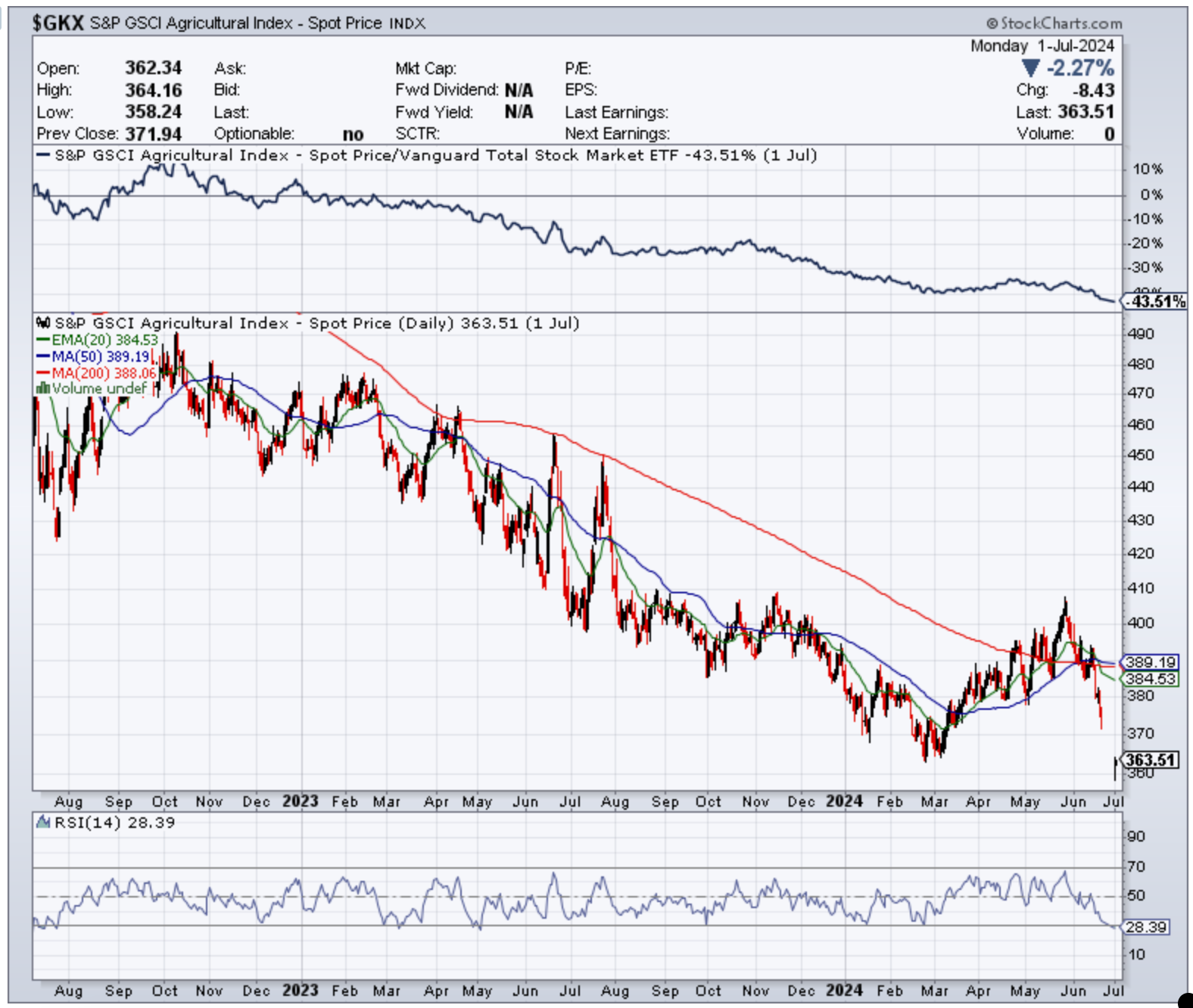

Four years later, with a plethora of sanctions on China still in place, the situation warrants a revisit. How is the GKX faring, you ask? Well, to put it bluntly, it had a heyday but now it's not looking great. A glance at the daily charts reveals that the 50-day moving average (DMA) is trailing below the 200 DMA—a classic bearish signal, until recently.

The GKX might be showing signs of changing it's fortune, the 50 DMA just popped above the 200 DMA, but it's a bit too early to tell.

And if we delve into the weekly charts, a "death cross" is well formed. For those not in the loop, this is a major red flag, signaling that being long on GKX might not be the wisest investment strategy at the moment. Yet, the peak price from the charts shows that it was above $580 and it looks like it might've been a combination of the Trump sanctions AND COVID-19 that pushed the index higher.

Inflation always pushes commodities higher, always.

What adds to the frustration is the obstacle I face in conducting my usual stock report. My go-to resource, Yahoo Finance, unfortunately, doesn't archive historical data for the GKX. This leaves me with limited options, like Stockcharts, which does offer some insights but at the cost of a subscription. And here's where my personal philosophy kicks in — I'm, let's say, financially prudent (cheap). Investing in a subscription to dig deeper into historical data doesn't align with my ethos of keeping expenses low.

This brings me to a broader reflection on managing personal finances, especially in the context of investing. The moral of my story? If you're aiming for wealth, adopting a frugal mindset is key. It's not just about cutting unnecessary expenses; it's about being strategic with where your money goes. I've become quite ruthless in trimming down subscriptions, except, of course, when my wife insists on keeping some or when they're absolutely essential for my investment research or other critical activities.

In essence, navigating the complex world of finance and trading as a lone investor has taught me invaluable lessons. Keeping a keen, albeit "lazy," eye on market movements, staying informed about geopolitical impacts, and managing finances with a blend of prudence and strategic investment in knowledge are the principles I live by. And perhaps, these insights might serve you well in your financial journey, too.

Get more with Premium

Member discussion