$100 Forex Trading Experiment Review

If you've been a reader of this site since 2007, then you'd know that I started trading Forex as an experiment in making money in late 2006 and through 2007. I wanted to see if I could take a small nominal sum of money of $100 and turn it into something greater. I did this to learn how to trade an insanely volatile market and how to navigate risk. Overall, that experiment was a success, I ended the year with 30+% returns!

Yet, it wasn't all fun and games as I saw my balance fall, then rise, and then fall again. It felt like making this 30+% rate of return was way harder than just investing in an index fund, and it was. Granted, I would've never made 30% investing in an index fund but that was a lot easier than sitting in front of my screen every day figuring out how many pips the Euro would move based on some news event.

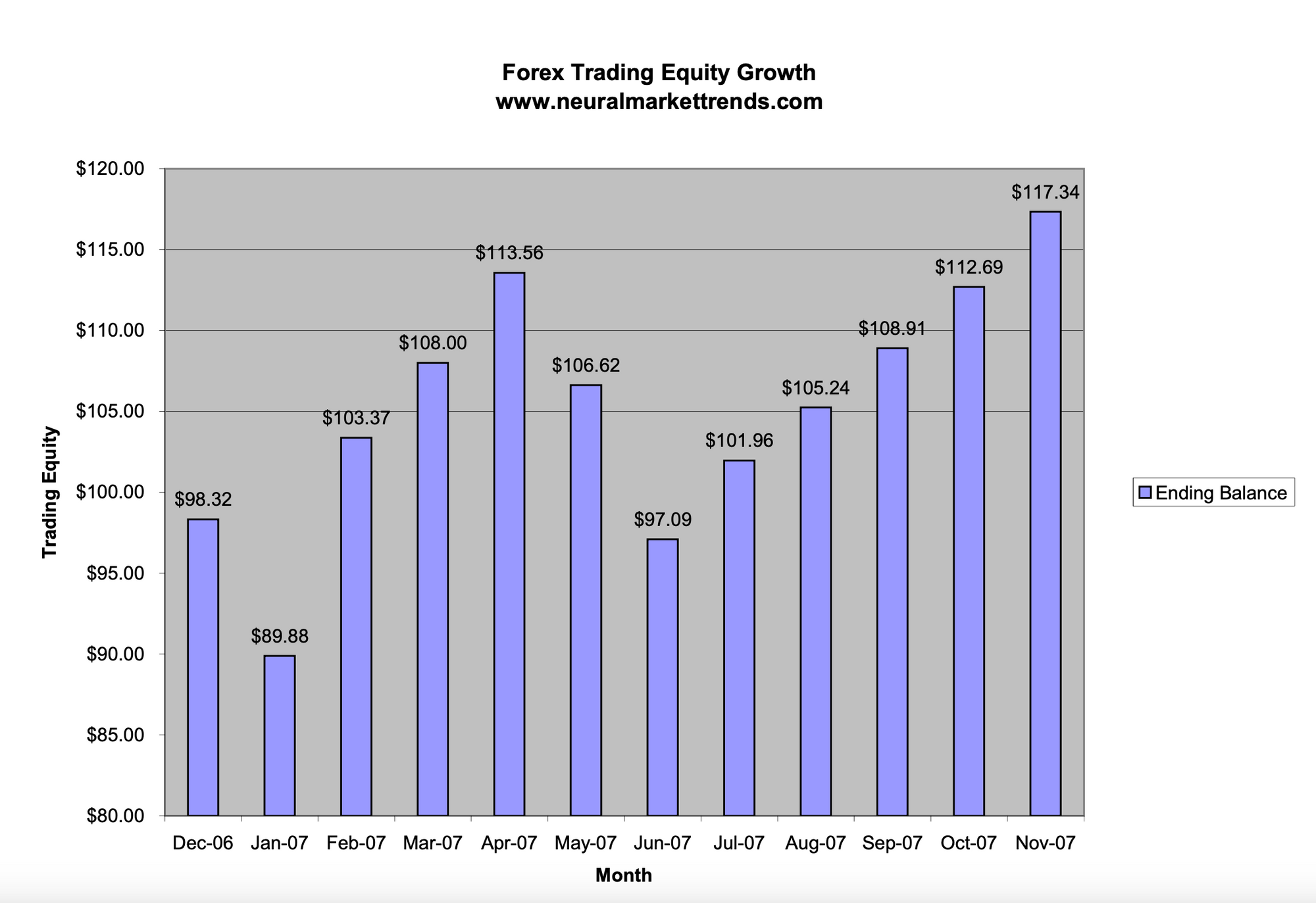

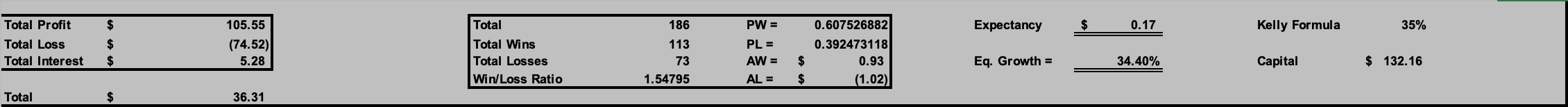

The chart below shows that by November of 2007, my ending balance was $117, roughly 17% more than my initial balance of $100 when I funded the account in December 2006. Although it's not shown in the chart, I closed the year in December 2007 with a balance of $132.16.

I learned a helluva lot from this little trading experiment. I placed a total of 186 trades, of which 113 were winners and 73 were losers.

My probability of winning a trade was just under 61% and I could expect to make $0.17 every time I trade. However, my average winning trade was $0.93 which was lower than my average loss of $1.02.

What kind of fancy system did I use to make all this money? It wasn't fancy at all! My trading system was simple, I just traded breakouts with trailing stops. That system worked nicely because I would place my limit orders before I went to bed and then close them before the NY session opened in the morning. I would catch the London market activity. That worked well right up till the 2007/2008 market crash.

Learning Risk Control

My trading system "kinda" worked, I liked my probability of winning being greater than 50% and having a positive expectancy. So many traders never calculate these numbers and wonder why their system keeps losing money. If you start out trading, one of the best things you could ever do is compile this data. It will tell you immediately if you will make or lose money.

What did these numbers mean to me? The fact that my average losses were higher than my expected winnings meant that I could "blow out" in the long run. It meant that my money management and risk control weren't tight enough and I will admit that I sometimes let my emotions rule my trades. Another recipe for disaster.

This is why running a Forex Trading Bot, written in Python or another language, might work a lot better because you can program in parameters and let it take you in and out of the market without emotions.

Learning These Systems

One of the best books you could ever buy to help you become a profitable trader is Van Tharp's book, Trade Your Way To Financial Freedom. It's the book that explains Expectancy Theory and how your trading system should be evaluated. You don't need to have a fancy trading system, it could be quite simple (as was mine), but what you need is a winning probability greater than 50%, preferably greater than 60%, and a positive expectancy. Of course, you have to watch those average winning and losing values too, but that's about it.

Evaluating your stock trading system, forex trading system, or whatever market you trade system through this lens will let you know if you're going to make money or not.

So, what's the general review of my $100 Forex Trading Experiment? It was a success but with hard lessons, lessons I've internalized and used over the past decade. It made me who I am today and I would it all over again, if I had to.

Member discussion